Country’s goods imports during summer months down 24% year on year, according to Kiel research.

China has become Russia’s main trading partner as imports from the EU contracted sharply following sanctions imposed by western countries in response to Moscow’s invasion of Ukraine. The Germany-based Kiel Institute for the World Economy calculated that in June, July and August, Russia’s goods imports were 24 per cent lower than for the same period last year, leading to a monthly import gap worth $4.5bn.

The fall was driven by contracting trade with the EU, down 43 per cent as a result of tough Brussels sanctions targeting the Russian economy, while Russian trade with China increased 23 per cent, making the world’s second-largest economy Russia’s top trading partner. Moscow stopped publishing most foreign trade data after the start of the war in February, “Since China’s exports are not sufficient to compensate for the drop of Russia’s trade with the EU, Russia’s efforts to replace slipping imports from Europe are proving increasingly difficult,” said Vincent Stamer, head of the Kiel Trade Indicator.

“The sanctions imposed by the western alliance are apparently hitting the Russian economy hard and noticeably limiting the population’s consumption options,” he added. The institute, which tracks shipping loads of 57 countries and the EU, reported that in October, cargo unloaded at St Petersburg, an important hub for trade with Europe, was a tenth of the volumes for the same month last year. Separate official Chinese data released on Monday showed that the value of China’s imports and exports with Russia rose by an annual rate of 35 per cent in October.

While this was a smaller annual rate than in the previous three months, the rise was in sharp contrast with China’s overall trade contraction. Russian goods exports and imports contracted in October, according to Kiel, falling 2.6 per cent and 0.4 per cent respectively month on month. Together with trade contraction in Germany and the US, monthly global trade volumes were down 0.8 per cent, according to Kiel analysis of worldwide shipments. “There is growing evidence that weakening demand in major economies is taking a toll on world trade,” said Leah Fahy, economist at the consultancy Capital Economics.

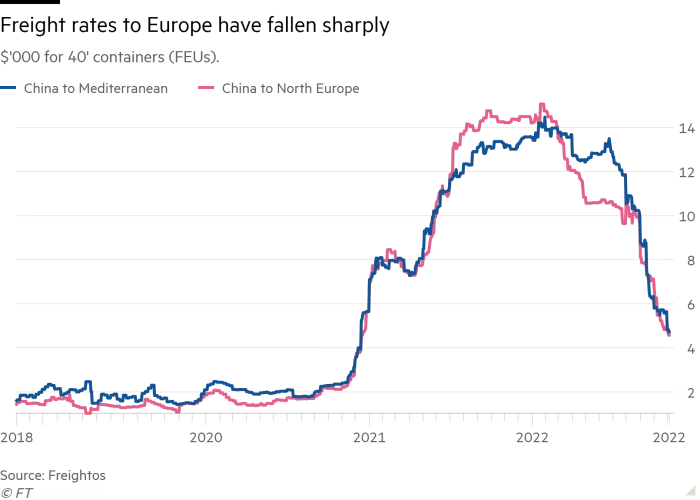

She forecast that global trade would fall on an annual basis from next year as more countries suffer a recession. Germany’s export-focused economy continued to be hit by turmoil in global supply chains, as imports into the country fell 0.9 per cent and exports also declined slightly in October, Kiel said. However, there was some optimism for German manufacturers as freight rates on routes between China and the EU have fallen two-thirds since the start of the year, taking prices for a standard container below $5,000 for the first time in two years, it said.

This followed an unexpected rise in German industrial production in September, despite output falling at the most energy-intensive manufacturers as they responded to soaring gas and electricity prices. Monthly production at German factories rose 0.6 per cent, driven by sharply higher automotive and pharmaceutical output. However, production in the country’s most energy-intensive sectors, such as chemicals, metals and glass, was down 0.9 per cent — taking the full-year fall to almost 10 per cent. New orders for German factories fell 4 per cent in September and analysts at Goldman Sachs warned they expected hard data on the German economy to “deteriorate significantly” from October, especially after Chinese exports to the EU dropped 9 per cent year on year.

Source : Financial Times